In Monte Carlo simulations, we illustrate the superiority of the proposed penalized estimation approach and argue that a combination of penalized and unpenalized estimation approaches results in overall best INAR model fits.

For the data-driven selection of the penalization parameter, we propose two algorithms and evaluate their performance. This is the case, for example, in the frequently used INAR models with Poisson, negative binomially or geometrically distributed innovations. Therefore, to improve the estimation accuracy, we propose a penalized version of the semiparametric estimation approach, which exploits the fact that the innovation distribution is often considered to be smooth, i.e. two consecutive entries of the PMF differ only slightly from each other. However, for small sample sizes, the estimation performance of this semiparametric estimation approach may be inferior. As a basic model of uncertain time series.

#Autoregressive process modeling via the lasso procedure series

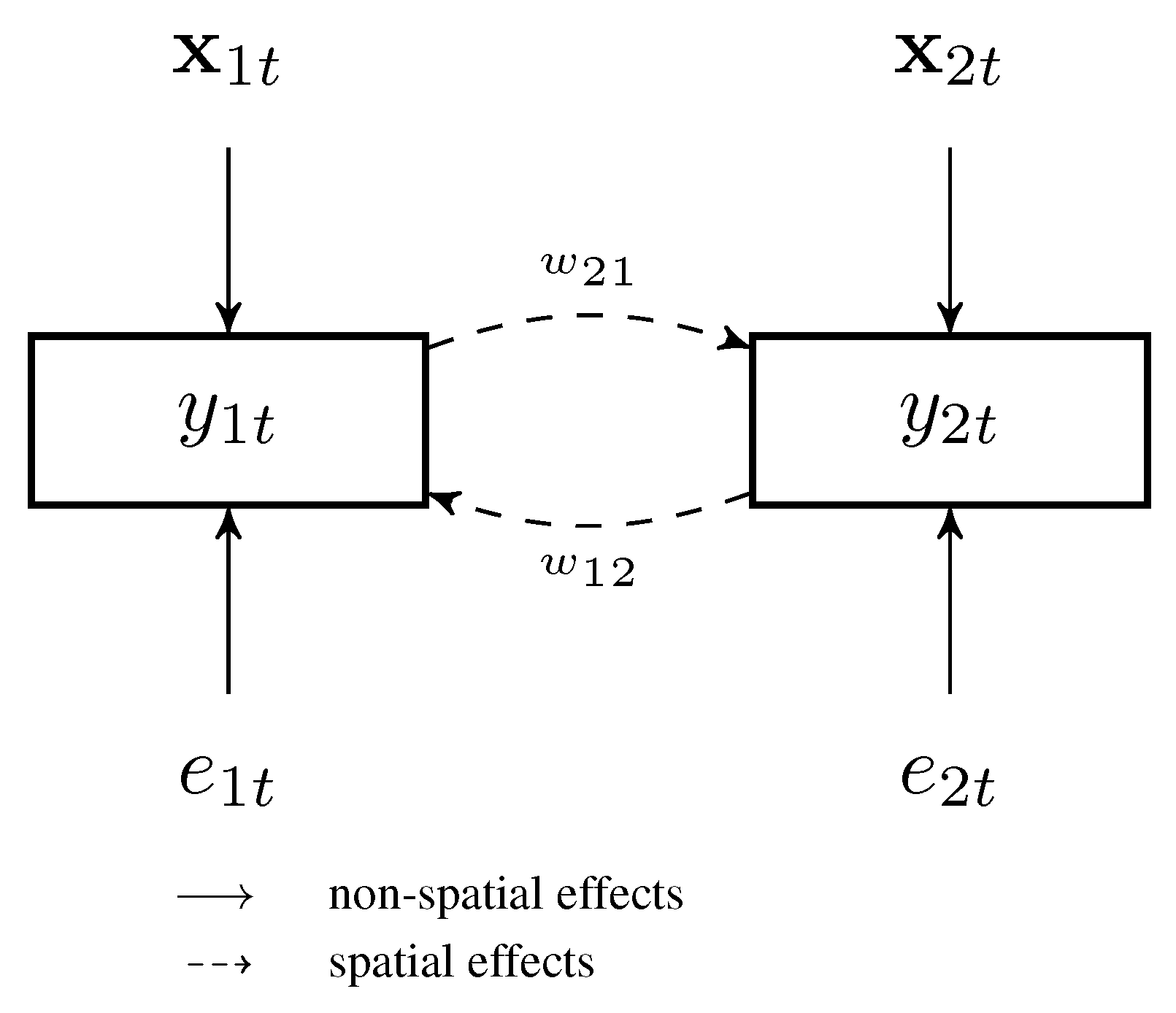

In this regard, a semiparametric estimation approach is a remarkable exception which allows for estimation of the INAR models without any parametric assumption on the innovation distribution. Uncertain time series analysis is a method to predict future values based on imprecisely observed values. Section 3 presents the gas flow network data on an. Wu and Wang (2012) used the shrinkage estimation procedure to analyze data using. Section 2 details the NNAR model and parameter estimation procedure using the profile least square method. penalty for both fitting and penalization of the coefficients. Therefore, an iteratively reweighted adaptive lasso algorithm for the estimation of time series models under conditional heteroscedasticity is presented in a high-dimensional setting. (1987) studied biological rhythm data by using the RegARMA model. It selects a reduced set of the known covariates for use in a model. Panel vector autoregressive (PVAR) models account for interdependencies and het- erogeneities across economies by jointly modeling multiple variables and. Here, the sparsity of the AR model implies some of the autoregression coefficients are exactly zero, that must be excluded from the AR model. However, currently lasso type estimators for autoregressive time series models still focus on models with homoscedastic residuals. It is useful in some contexts due to its tendency to prefer solutions with fewer non-zero.

Popular models for time series of count data are integer-valued autoregressive (INAR) models, for which the literature mainly deals with parametric estimation. 13 Citations Metrics Abstract We study the adaptive least absolute shrinkage and selection operator (LASSO) for the sparse autoregressive model (AR). The Lasso is a linear model that estimates sparse coefficients.

0 kommentar(er)

0 kommentar(er)